[ad_1]

WEF Davos 2023 What The Elites Are Planning

What Plans Do They Have For Us

Guy of CoinBureau.com does a great job of laying out what went on this year at the Davos meetup.

https://youtu.be/uuWkQyVzsKs

WEF Davos 2023: Everything The Elites Are Planning!!

2.21M subscribers

176,061 views Jan 29, 2023

WEF Davos 2023 What The Elites Are Planning

BROUGHT TO YOU BY: CryptoGrizz.com

VISIT OUR OTHER SITES:

Check Out Our Crypto Privacy Site: CryptoGrizz.com

Check Out Our Crypto Trading Site: CryptoGrizzTrader.com

Check Out Our Low Cap Altcoin Site: CryptoGrizzAltcoins.com

Check Out Our Prepper Site: PrepperGrizz.com

Check Out Our Prepper Survival Site: PrepperSurvival.org

Check Out Our Global Crypto Survival Site: GlobalCryptoSurvival.com

FULL VIDEO TRANSCRIPT

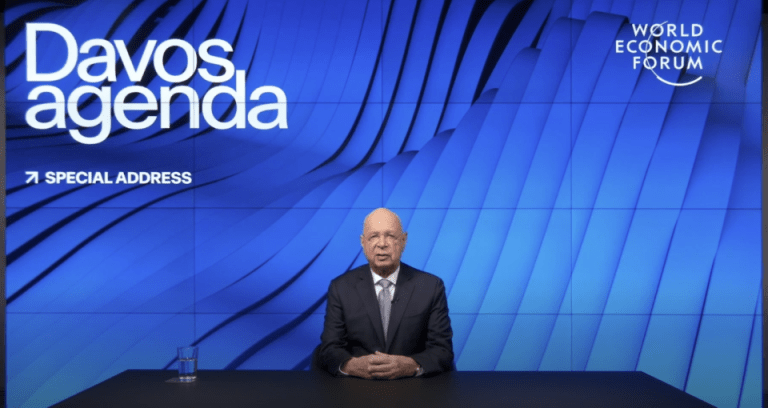

0:00last week thousands of soldiers were deployed to protect three thousand of0:05the world’s most powerful people who were gathered in Davos Switzerland they0:10were there for the world economic forum’s annual conference to discuss the future of the planet without input from0:17us plebs of course the event featured dozens of discussions which revealed what the elites are0:24planning for 2023 so today I’m going to summarize the most important Davos0:30discussions explain why they’re so significant and tell you exactly what it all means for you this is a video you do0:38not want to miss0:43as with all previous Davos conferences the event began with a brief speech from0:49World economic Forum or weft founder and chairman Klaus Schwab who’s been likened0:55to a real-life Bond villain he certainly sounds a lot like Stromberg from the spy who loved me and the1:01reflective jumpsuits worn by the henchman sorry Swiss soldiers guarding the event only made the whole vibe that1:08much more accurate maybe that was deliberate who knows anyway Klaus started his speech by1:16revealing the theme of this year’s Davos conference which was quote cooperation in a fragmented world1:24Klaus went on to describe all the different crises the world is facing in1:29a way that sounds like they were intentionally caused by the weft I’m not1:34exaggerating Klaus went on to imply that these crises Were Somehow part of his Infamous fourth1:42Industrial Revolution and said that the wefts so-called stakeholders need to turn these crises into opportunities1:50note that the wefts stakeholders are its members all famous and powerful people1:57after his speech Klaus introduced Alam Bessette the president of Switzerland2:02who revealed that the quote post-war order is experiencing its greatest2:07crisis for context the post-war order is a reference to the aftermath of World War2:12II where the United States and its allies gradually took over much of the world Allah also said that populism around the2:20world is increasing due to the rising cost of living and said that quote this2:25growing inequality creates issues for us consider that us means the wefts2:31stakeholders now I take this as a tacit admission that the weft knows it is2:38becoming increasingly unpopular on that note many headlines highlighted the fact2:43that the relevance of the weft appears to be fading as a result of this unpopularity it’s believed that the2:51wefts unpopularity is why some powerful people who had previously attended the2:56Davos conference decided not to come this year glad they got the message3:01now the discussions at this year’s Davos conference were supposed to cover five3:07key themes the climate and energy crisis the economy new technologies changing3:13the way we do work and addressing the current geopolitical risks not3:18surprisingly these weren’t exactly the actual themes based on my assessment of3:23the discussions most of them focused on a different set of key themes including metaverse control online censorship and3:32financial centralization so I’ll be focusing on these themes today along3:37with cryptocurrency because I know you all want to hear what the weft said about that note that you can find our3:45coverage of last year’s Davos conference in the description I suggest checking it out after this video to see how much it3:52contrasts with this year’s DeVos conference it seems that the speakers were a lot tamer in their rhetoric due3:59to public scrutiny of the weft more about that later now let’s start with the metaverse which4:06had three discussions devoted to it the most significant of these was about the4:11wefts so-called Global collaboration Village a metaverse for the elite which4:16is being built by the weft in partnership with Microsoft and consulting company Accenture4:23the discussion about the Virtual Village featured Klaus Accenture CEO Julie sweet4:28and Microsoft president Brad Smith the discussion was moderated by Adrian Monk4:34a managing director at the weft now this is interesting because almost all the4:40other discussions were moderated by the mainstream media Klaus started off by4:45saying that the wefts metaverse is a quote dream come true because it allows the weft to focus on a quote bottom-up4:51instead of top-down influence this immediately reminded me of how the4:57weft is using young global leaders and Global Shapers to ensure the great reset5:03occurs speaking of which most of the people in the audience who are asking questions during these panel discussions5:10were young global leaders and Global Shapers according to Klaus there are5:15more than ten thousand of them working their ways into positions of power and some quite likely near where you live5:23more about that in the description moving on Klaus went on to reveal that there’s5:30already a Consortium of more than 80 so-called Village Partners which of course includes lots of other unelected5:37and unaccountable international organizations Klaus finished by saying that he hopes The Village will increase5:44the impact of the wefts agenda the next ago was Julie and she said that5:50Accenture expects the value of the metaverse to grow to more than one5:55trillion dollars by 2025. this is primarily because of adoption by6:01Enterprise and Industrial focused firms that will use the metaverse to train employees which to be fair is pretty6:08awesome what’s not so awesome however is that Accenture also hopes that the metaverse6:14will become a key component in the education of children now call me crazy6:20but I don’t think putting children in Virtual Worlds from a young age is a6:25good idea especially if the curriculum is coming from a weft Affiliated institution in any case Brad was the6:33last panelist to a pine and he spent most of his time talking about how he hopes The wefts Village will have no6:39borders and will onboard essentially everyone on the planet this made me wonder whether the wefts new end game is6:46to push everyone into its dystopian metaverse funnily enough one of the audience questions was about how the6:53weft will address the fact that nobody trusts institutions like the weft and6:58will therefore view the village with suspicion Klaus said that the weft will ensure that the village is governed to7:05maximize the safety of its inhabitants yikes now the second metaverse discussion was7:12titled quote how to build a metaverse for all it featured moderator Kirsten7:18salier the wefts head of editorial strategy AKA propaganda Kathy Lee the head of the wefts shaping7:25the future of media initiative suyat the co-founder of animoka Brands and Huda7:31al-hashimi Deputy Minister for strategic Affairs of the United Arab Emirates7:37Kathy started off by revealing that the weft is working with over 100 companies7:42to make the metaverse accessible to everyone she revealed that the wefts metaverse7:48initiative was launched last May and it focuses on the quote governance of the7:53metaverse and the metaverse economy if that wasn’t concerning enough Kathy then7:59explained that the metaverse is not the wefts end game as far as digitization goes she failed to explain what exactly8:06the wefts endgame is in this department and I suspect it’s to have microchips in8:12all of our brains so that we can all be controlled in the name of safety what’s amazing is that Sue repeatedly pushed8:18back against the excessive control the weft is not so subtly seeking in the metaverse he warned that if property8:25rights in the metaverse are not guaranteed then nobody will invest in it or use it8:31this is something the weft and its Affiliates don’t seem to understand as8:36for Huda she likewise seemed opposed to the idea that the metaverse requires a8:41close partnership between the public sector and private sector she argued that Regulators should be more like8:48referees and that it should ultimately be up to the communities to set more specific rules and standards Huda also8:56expressed concern about the effects that spending too much time in the metaverse could have on Mental Health this ties9:03into what I said a few moments ago about it not being a good idea to stick children in the metaverse from the9:09moment they have the capacity to put on a VR headset now whereas the second panel discussed9:15how to build a metaverse for all the third panel discussed how to actually build the metaverse this panel was aptly9:23titled a new reality building the metaverse and it featured the following personnel Nicholas Thompson the CEO of9:31mainstream Media Company the Atlantic as moderator of course Chris Cox the chief9:36product officer of meta Enrique Loris the CEO of HP Paula ingebyer the Rwandan9:43Minister for information and Neil Stevenson the author of snow crash who coined the term metaverse in that very9:50book now to be honest this panel discussion was actually pretty good in retrospect I9:57think it’s because it wasn’t scripted at least not to the extent of the other panel discussions I noticed that10:02panelists on other discussions were constantly checking notes perhaps they were instructed to stay uncontroversial10:10regardless Neil was the first panelist to speak he explained that his idea for10:16the metaverse came from Imagining the cost of video game Hardware coming down exponentially he revealed that he’s10:24working on an open source metaverse blockchain and insisted on decentralized10:29and interoperable digital IDs Chris was the next to take the mic and he revealed10:34that the reason why Graphics in the metaverse suck is because of concurrency issues in plain English it’s hard to10:41have good graphics in a virtual world with thousands of people and apparently there’s a limit to how much better10:47Hardware can help not surprisingly Chris pushed back against Neil’s claims that10:52the metaverse should be open source and decentralized arguing that centralization is required for privacy10:58and safety surprisingly Enrique seemed to side with Neil probably because meta is building11:05metaverse Hardware following Paula’s pondering about all the wonderful things the metaverse could11:10be used for the weft’s own metaverse Mastermind Kathy Lee randomly appeared11:15on stage to reveal that the panelists were a part of the wefts so-called defining and building the metaverse11:22initiative that I mentioned earlier what a way to ruin an otherwise positive panel discussion11:28now when it came to the wefts discussions around online censorship there were also three panels and the11:34first two appear to have taken place back to back the first panel was bluntly titled quote11:40the clear and present danger of disinformation and it featured everyone you’d expect11:46the moderator was former CNN anchor Brian stelter who was fired last summer for being so unpopular the panelists11:53were Arthur Greg salzburger the chairman of the New York Times Vera Jova a vice11:59president at the European commission who was instrumental in putting together its recently passed censorship laws12:05Gene Borgo the CEO of interview and a U.S politician named Seth Moulton12:12Bryant started by telling everyone to tweet about the weft with a certain hashtag to ensure that quote real12:18information gets out there then Arthur admitted that disinformation lies at the12:24core of every problem the weft is trying to solve in other words stop repeating12:29what we say with additional context Arthur went on to admit that distrust in12:34institutions is the most dangerous threat to the extreme centralization the weft is seeking I’m paraphrasing of12:41course Arthur also stressed that the only way to fix the issues of disinformation and12:47distrust are for governments to partner with mainstream media if you watched our video about online censorship you’ll12:54know that’s basically what the EU is doing with its Digital Services Act in the panel Vera explained that13:01removing content in the name of disinformation would be wrong which is why the EU is working with big Tech to13:07make it impossible to find instead Vera also advocated for quote pre-bunking13:12which is where you prevent or discourage people from posting anything that goes against the official narrative13:18she confirmed that the eu’s regulation applies to hate speech and even admitted13:24that 90 of content removal requests are from governments let that sink in ninety13:31percent of content takedown requests on social media come from those in power13:37Vera’s comments seem to have shaken Seth who warned that the EU may be going too13:43far with its online censorship aspirations this says a lot considering Seth is also in favor of online13:49censorship in the name of disinformation he just seems to be more concerned with disinformation affecting his voter base13:55after a few irrelevant comments from Gene Arthur asserted that chat GPT will14:01make disinformation worse this is simply because there will be too much content14:06and too many claims for any person or computer to moderate Arthur’s solution14:12is to give the mainstream media even more powerful tools it was at this point that Jean made a14:18very relevant comment and that’s that the weft and its so-called stakeholders should focus on influencing local media14:25this is because people trust local media more logically then local media must be14:32subservient so that the West’s agendas can be achieved if that wasn’t Sinister enough Vera added that the eu’s Digital14:39Services act will make it next to impossible for fake news outlets to receive any funding Arthur somehow took14:47it a step further by saying that children should be trained from a young age to detect fake news you honestly14:54can’t make this stuff up the panelists essentially concluded that the only solution in the short term is to promote15:00information from trusted sources and suppress everything else this is exactly15:05what the eu’s Digital Services act will do in the event of a crisis it’s awfully15:11convenient that there’s no shortage of crises to choose from now the second panel discussion about online censorship15:17was titled quote disrupting distrust and it featured A peculiar lineup15:23the moderator was Kathleen Kingsbury an opinion editor at the New York Times panelists included Angela Williams the15:31CEO of United Way Richard Edelman the CEO of a company that tracks trust Salah15:37Goss VP for social impact and MasterCard and Helena Laurent the director of15:43consumers International Kathleen started by revealing that the weft is explicitly quote trying to15:49increase trust in stakeholders by now you’ll know that this is code for the powerful individuals and institutions15:56that make up the world economic Forum it seems that our distrust made its way to16:02Richard’s database because he revealed non-governmental organizations like the weft cease to be the most trusted16:08institutions after the pandemic began Richard claims that the decline in trust16:14is due to economic conditions which is insane and demonstrably false if you watched our aforementioned video about16:21online censorship you’ll know the decline in trust is due to unprecedented pandemic restrictions and their shifting16:27justifications economic conditions I mean really the stock market was rallying and everyone was getting stimi16:34checks Richard went on to reiterate that trust has gone local meaning that most people16:41trust their local institutions more than National or International ones he then16:47emphasized that economic inequality is driving distrust this makes me wonder if16:53this is why the elites want Universal basic income so badly now unfortunately16:58Ubi is a topic for another time but if you want to know my take you can check out our video about worldcoin the crypto17:05project that’s scanning the eyes of people in developing countries in exchange for tokens that will probably17:11be worth close to nothing once they can actually cash them out anyhow Angela17:16revealed that United Way has been actively engaging with communities to understand why there’s so much distrust17:23oddly enough she couldn’t communicate where exactly the distrust is coming from this tells me that it’s something17:30she either can’t say or the folks at the weft don’t want to hear meanwhile Salah17:37revealed that mastercard’s focus on diversity and inclusion is to make minority groups feel like they can trust17:43the payments company this is pretty disturbing because it suggests that the entire corporate diversity and inclusion17:50pitch has an underlying profit incentive later in the discussion Richard made the17:56Bold claim that the decline in trust in institutions like the weft is due to right-wing propaganda this is a bit odd18:03because by that point the other panelists had made it clear that trust is lowest in minority communities which18:09are not right-wing by their own assessment now the question period was particularly revealing the first18:16question was something along the lines of quote right-wing entities are criticizing ESG investing which is18:22causing distrust of big business big businesses are essentially the only trusted institution left and they’re18:28required for the wefts agenda what do we do the panelists said the answer is to18:35double down on ESG and to try and build trust locally by infiltrating and influencing local institutions18:42presumably with the help of young global leaders and Global Shapers ironically18:47the next question came from a global shaper based in Melbourne Australia she18:53asked the panelists what they can do about increasing the Trust In institutions that do not want to be18:59transparent now I want to say that this is a subtle shot at the weft but if it19:04was well I reckon that young lady wouldn’t have been there in any case the panelists didn’t have a clear answer19:12one of the last questions came from a chap who seemed to be passionate about crypto that’s because he said that19:19cryptocurrencies are trustless and asked whether there was a way trust could be improved with crypto19:25this is where Helena made her only meaningful contribution you can’t fix19:30trust with tech I suppose it all depends on who makes the tech but that’s yet19:36another topic for another time anywho the third panel discussion about online19:41censorship was innocently titled quote tackling harm in the digital era the19:47moderator was pranjal Sharma editor at business world the panelists were Melanie doors the head of the UK’s19:54Communications regulator Vera gerova the censorship tsar of the EU Petra de20:00Sutter the Telecommunications Minister of Belgium and Julie Inman Grant Australia’s e-safety commissioner20:07naturally most of the panel focused on online censorship in the name of Online20:12safety there was no shortage of contradictions such as anonymity online should only be for people in oppressive20:19countries this is contradictory because forcing people to complete kyc to use the Internet is well oppressive20:27there was lots of talk about quote virtual seat belts and quote safety by Design Julie revealed that she used to20:35work at Twitter’s safety department this isn’t something to be proud of given the recent bombshell reports about Twitter20:41safety working with governments to censor information online Julie also revealed that she’s working20:48on establishing e-safety Commissioners around the world and that Canada will be the next country to sign on this is not20:55surprising given that Canada is in the process of passing the most restrictive online censorship laws Julie says these21:02Commissioners will work together and you know I messaged an Aussie mate of mine and he can’t say he remembers21:09voting to have an e-safety commissioner that’s the weft for you and speaking of21:15which Vera then revealed that the eu’s definition of hate speech includes any21:20criticism of ngos like the weft as well as judges it’s almost as if the EU is21:27anticipating lots of lawsuits against excessive censorship by its Digital Services act and will ban any criticism21:34of the eu’s bias legal processes there’s not much to add from the other panelists21:40and I honestly don’t need to you get the point now for financial centralization21:46there were quite a few discussions that fell under this broad umbrella so for now I’ll focus on four and the first was21:53about everyone’s favorite topic Central Bank digital currencies or cbdc’s it21:59seems that even the weft is aware that cbdcs are unpopular this is because the22:05panel was titled quote in the face of fragility Central Bank digital currencies22:10the discussion was moderated by Neha narula who is the director of mit’s22:15digital currency initiative which recently published a report about its progress in developing a digital dollar22:21with the FED other panelists included Leva mostre the CEO of euroclear Le22:27Setia khanyajo the governor of South Africa’s Central Bank Javier Perez tasso22:33the CEO of Swift and the ayaron the governor of the Central Bank of Israel and Julio velarde governor of the22:40Central Bank of Peru Neha started by basically offering her condolences to22:46Julio over the fact that peruvians had been violently protesting against their government for months Julio gave an22:53awkward thank you probably because Central Bank policies may have had an impact on the things that Peruvian22:59citizens are protesting about Julio went on to reveal that the government has been working closely with23:06the IMF to develop a cbdc which is odd given that the bank for international settlements or bis is the international23:13institution that’s been working with most other central banks on cbdcs then23:19again there have been a bunch of independent cbdc trials such as project23:24Icebreaker Amir explained to the panel that project Icebreaker was the first cross-border retail cbdc trial that was23:32completed with the help of the central banks of Norway and Sweden along with Israel what’s interesting is that Amir23:39admitted that it’s been very hard to find people to build cbdc technology23:44this is interesting because I’ve long speculated that the people who are capable of developing digital currencies23:50are building cryptocurrencies and not cbdc’s that’s simply because they can23:55make a lot more money building cryptos and will also be worshiped rather than hated by the average person24:02what’s hilarious is that Neha straight up asked Javier why central banks need24:07the Swift payment system when they can seamlessly send transactions using cbdc’s Javier said that it’s a lot more24:14complicated than it seems and that Swift has been working with the bis on optimizing cbdcs for those unfamiliar24:22euroclear is similar to Swift rather than talk about the technological24:27aspects of cbdc’s lever focused her defense of financial intermediaries on liquidity she explained that Atomic24:34swaps with cbdcs will have lower liquidity than standard cross-border payments fascinating24:41as for La secha all he could say was that cbdc’s seem to be a solution in24:46search of a problem his comments actually made the crypto headlines and he’s not wrong24:52everything that cbdc’s do stable coins could do better which is why central banks seem to be interested in them of24:59late note that the weft has been a big proponent of this so-called synthetic25:04cbdc setup more about that in the description now the second panel about25:09financial centralization was titled what next for monetary policy if you’re25:14wondering why I’m including this panel discussion under Financial centralization it’s because central25:20banks influence interest rates and the FED has been crashing the market with rate hikes25:26the moderator was jumana beseche of CNBC the panelists were Larry Summers from25:32Harvard Swiss National Bank chairman Thomas Jordan Kirsten brathan the CEO of25:37Norway’s largest Financial Services Group and our nervous friend Julio villade the governor of the Central Bank25:44of Peru Thomas started by saying that the Swiss National Bank is committed to25:49Bringing inflation back down if that rhetoric sounds familiar that’s because fed chairman Jerome Powell has been25:55saying the exact same thing this might have something to do with the fact that central banks work together via the bis26:03like many Market analysts Larry claimed he knew inflation was coming since 202126:09and believes that it’s going to continue for quite some time what’s interesting is that the panel seemed to focus on26:16Larry this might have something to do with the fact that he’s a former U.S treasury secretary and was pipped to the26:22post of Fed chair by our old buddy Jerome Powell Larry was asked about whether central banks should change26:29their two percent inflation targets Larry firmly responded no because investors will know that if it’s been26:36changed once then it can be changed again this will undermine The credibility of central banks and lead to26:42hyperinflation what’s funny is that Larry said interest rates will remain higher for longer because of persistent26:49inflation not a moment later Thomas said that the Swiss National Bank is prepared26:55to bring interest rates back to negative territory at a moment’s notice seemingly pivoting on stage in real time27:03jumana took this contradiction as an opportunity to point out that the Swiss National Bank had posted a record loss27:10of a hundred and forty three billion dollars last year for context the Swiss National Bank holds a broad basket of27:17assets including U.S stocks Thomas argued that it would have been worse if27:22it had held U.S bonds that’s because in 2022 U.S bonds saw their worst year27:28since the late 1700s which is absolutely Wild meanwhile Julio revealed that Latin27:35American central banks will probably be pivoting soon this is because they were the first to raise interest rates and27:41they did so aggressively Kirsten didn’t add much to the conversation and admitted that she felt27:47a bit under qualified compared to the other panelists that’s pretty impressive because humility is a rare trait of27:53these so-called stakeholders now the question period was likewise unimpressive which is unfortunate27:59because the questions were actually pretty good the one that stuck out to me was whether there’s a danger of having28:04interest rates too low or in the negative for too long nobody on the panel could provide a clear answer so28:12much for the experts this ties into the third panel about financial centralization which was28:18titled quote staying ahead of a recession the discussion was moderated by Bloomberg editor Francine Lacroix the28:25panel featured Douglas Peterson’s CEO of the s p Axel Lehman chairman of Credit Suisse Laura Char chairwoman of the Hong28:33Kong exchange and Mario centeno governor of the Central Bank of Portugal I remember Laura from last year’s Davos28:39conference she was on an ESG panel with other ESG ideologues like Bank of28:45America CEO Brian Moynahan discussing how they’re not going to give any funding or provide banking services to28:51any companies that don’t comply with ESG the discussion underway axel said that28:57he sees a multi-polar world emerging Laura said that China’s reopening will be bullish Douglas said that there will29:04be a mild recession Mario said that inflation is coming down but central banks will continue to fight it he also29:11said that a tight labor market is why the recession will be mild not surprisingly the panelists all29:18promoted ESG as the obvious answer to every possible economic issue even though it caused the energy crisis29:25you’ll know this if you watched our video about ESG and cryptocurrency and you’ll also know ESG investors care the29:32most about G for governance AKA control in terms of risks Douglas said there are29:39credit risks I.E some big institutions could default on their debts because of higher interest rates Laura said there29:45are lots of geopolitical risks and Mario agreed axel said the biggest risk of all29:51is social unrest in case the Swiss president didn’t make that clear enough now the fourth panel about financial29:58centralization was similarly straightforward it was titled quote financial institutions innovating under30:05pressure and it was moderated by CNBC anchor Steve Cedric the panelists were30:11Ronald o’hanley the CEO of State Street Lynn Martin president of the New York Stock Exchange Dan Shulman the CEO of30:18PayPal Mark susman the CEO of the Bill and Melinda Gates Foundation and Muhammad al-jadan Finance Minister of30:26the Kingdom of Saudi Arabia Steve started by taking a subtle dig at El Salvador over its Bitcoin adoption30:33before giving the stage to the panelists Lin was the first to speak and literally said that extreme Financial30:39centralization is required to protect against unwanted volatility hence why I30:45included this panel under Financial centralization the next to go was Mark who was wearing30:51a pin that many have associated with the wefts great reset agenda in reality the30:57pin is a reference to the United nations’s sustainable development goals or sdgs which are being pushed by the31:04private sector via ESG with the help of the wef more on that later now I must31:11admit that Mark spoke as if he was outright instructing all the institutions present as to what they31:17ought to do regarding the economy the only thing more cringe was watching Dan push the talking point of blockchain not31:25Bitcoin an outright saying that the financial system must control this technology Ronald took a different route31:32because he shed light on the fact that nobody really knows how much debt there31:37is in the financial system or who holds it a little later Ronald was asked a31:42question by a young Global leader in the audience about sustainable Finance one of the many ESG synonyms Ronald said31:50that ESG investing has been hard because most environmentally conscious companies are Grassroots startups that can’t31:57receive massive amounts of funding Ronald also said that Wall Street wants to quote securitize national resources32:05this is code for taking possession of all Land and Sea turning it all into stocks and trading them on stock markets32:12Lin confirmed that natural resources will soon start trading on stock32:17exchanges thanks to the SEC pure evil okay let’s lighten the mood a little bit32:23shall we there were two panel discussions related to cryptocurrency the first was titled quote finding the32:31right balance for crypto Bloomberg News editor Stacy Marie Ismail was the moderator and the panel featured32:37the following not so crypto personnel class not president of the Dutch Central Bank and head of the Global Financial32:44stability board marade McGinnis the EU commissioner for financial stability Brad garlinghouse the CEO of Ripple and32:52Omar Sultan al-olama minister of digital economy of the United Arab Emirates32:58the discussions were predictably anti-crypto what was not predictable33:03however was that even the moderator would be vocally anti-crypto Stacey Marie started by asking how it’s33:10possible that FDX was licensed in Dubai and Omar had to explain that there are33:15multiple levels of Licensing Murray explained that the eu’s upcoming Mica33:20regulations will not stifle Innovation but prevent crypto from becoming a wild west class said that crypto companies33:28are located in quote sunny places with Shady people and said that the FSB would33:34be publishing crypto regulation recommendations by the summer as we’ve seen with the financial action task33:40force or fat F the regulation recommendations made by these unelected and unaccountable international33:46organizations are anything but failing to fall in line typically means that the33:52institution or country faces sanctions or restrictions from Western entities at33:58the same time Brad started blasting Stacy Marie for implying that the UAE has a quote light touch when it comes to34:05crypto regulation Stacy Marie doubled down on her anti-crypto rhetoric by asking Omar whether it was true that 3534:13percent of people in the UAE were affected by the collapse of FTX Omar had34:18no idea where that statistic had come from so the mic was temporarily turned to class who was asked whether the FSB34:26is keeping track of illicit activity in crypto Stacy Marie followed up with Omar34:31by asking him why it is that crypto criminals try to escape to the UAE Omar34:36was stunned Brad butted in to point out that FDX was like Bernie Madoff scheme34:42which had been reported to the SEC before it collapsed but the SEC ignored the warnings for some unknown reason34:48note that FTX founder Sam bankmanfried had met with SEC chairman Gary Gensler34:54on more occasions than with any other regulator class added to the tension by saying35:00there’s a need for Global crypto regulation especially because the crypto industry will actively resist regulation35:06according to him I would invite class to find an industry that’s welcoming of35:11Regulation that’s not controlled by a monopoly that’s paid off politicians after Stacy Marie admitted that she35:18didn’t hold any cryptocurrency it was time for the question period the first question came from someone at chain35:24analysis who asked class whether the fsb’s figures for illicit activity in crypto were being overstated plus35:31implied that chain analysis is understating crypto crime the panel ended with Stacy Marie getting35:38into a spat with Brad over the collapse of the crypto Market she asked when the crypto Market could recover in an35:45intimidating way that motivated Brad to highlight that many tech stocks have crashed more than some cryptos yet you35:52don’t see calls for regulation there now you know why there were almost no crypto35:57headlines about the only purely crypto discussion at Davos coindesk was the36:03only crypto media outlet that covered this discussion and somehow painted it in a neutral light36:09speaking of which the second crypto related panel discussion was moderated by coindesk Chief content officer36:15Michael Casey the discussion was titled quote tokenized economies coming alive and it appears to have been hosted in a36:23sub-optimal venue though it featured the following surprisingly cryptocentric panelists36:28Jeremiah CEO of usdc stablecoin issuer circle36:35CEO of bitcob capital Teemo haraka finland’s minister of transportation and36:41Beryl Lee the co-founder of yield Guild games more about those guys down in the36:46description it’s definitely an interesting crypto project now I couldn’t help but notice Jeremy looking36:52over at Teemo wondering what the hell a Finnish Transportation Minister was36:57doing on a panel about crypto-related tokenization this is because Teemo admitted that he’s not that familiar37:04with crypto or tokenization but was eager to learn well Teemo I know a37:09YouTube channel that can definitely help you with that now as you might have guessed Michael spent quite a bit of time going back and37:16forth with Jeremy Jeremy just explained how circle is tokenizing the most important asset of all which is of37:23course the US dollar Michael went on to press Jeremy about programmability and37:28other stuff the weft seems to love jiriot spent his limited time in the spotlight talking about how Thailand is37:34working on a wholesale cbdc among other mostly irrelevant things and Teemo37:39randomly started calling for clearer crypto regulations and got on with Jeremy about digital ID note that circle37:47is working on digital ID with its verite platform more about that in the description37:52Jeremy also saw eye to eye with Teemo about regulatory Clarity for crypto and37:58the whole time Beryl was just sitting there watching The Exchange in awe during The Question period Jeremy was38:04asked about non-custodial crypto wallets and said something that’s arguably very incorrect Jeremy said that when you have38:12a stable coin or digital ID in a non-custodial wallet then you truly own both assets this is not true because38:20stable coins are centrally controlled and can be frozen by stablecoin issuers at any time digital IDs are likewise38:28connected to government-issued IDs which can be revoked anyway the panel ended with Chariot38:34talking about how he’s been talking with Bill Gates about how to reduce carbon emissions which is all you need to know38:41newsflash over consumption is causing all the environmental issues we’re seeing and over consumption is being38:47incentivized by inflation due to money printing if we had a hard money system38:53that incentivized people to save rather than spend then overconsumption would come down and all the environmental38:59issues the elites claim to want to solve could eventually solve themselves without having to pass a single law or39:06regulation or ESG mandate more about that in the description39:11now I know this video is getting long but there are two more panel discussions that I absolutely must cover the first39:18was titled quote global economic Outlook is this the end of an era it was the39:25final panel discussion at Davos and it was also the longest don’t worry I’ll keep it short39:30the panel was moderated by CNBC anchor Jeff cutmore and featured some of our39:36favorite overlords crystallina georgieva managing director of the IMF Christine39:41Lagarde president of the ECB Bruno Lemaire a French Finance Minister Larry39:46from Harvard and karoda harohiko governor of the bank of Japan Jeff started off with a colorful39:54overview of each panelist for christalina he said she’s concerned about a de-globalizing world for Bruno40:00he said he’s concerned about green energy for Christine he said she is staying the40:05course on fighting inflation for coroda he said he’s fighting the bond market and for Larry he said he’s the former40:12treasury secretary I suppose that’s exciting enough on its own40:17crystallina started by saying that the economy isn’t doing nearly as badly as the IMF had initially projected she said40:24that China reopening should lead to a Resurgence in its economic growth but could also cause inflation repressures40:31crystallina said that the Ukraine war could be a risk as well but mostly to Europe she then revealed that the40:38reshoring of Supply chains that we’ve seen as a result of the pandemic and the war in Ukraine is going to do damage to40:44Global GDP but this damage can be contained if countries continue to work together as much as possible recall the40:52theme of this Davos conference Larry urged central banks to continue fighting inflation and warned that the last part40:59of the inflation battle is the most painful and difficult he also said that Global integration should never come at41:06the cost of social disintegration which is probably the only thing I agreed with from all the Davos discussions41:14Christine confirmed that the ECB will continue to fight inflation and amusingly said that 2022 was a quote41:21weird year she urged governments to stay the course on the digital and green41:26transformation that the weft stakeholders pushed through with their pandemic restrictions more about that in41:32the description now Christine also casually said that China’s reopening will kill lots of41:38people but it will grow the economy so it’s fine she then proceeded to cross her arms after realizing what she had41:45said out loud they truly put the best brightest and most compassionate on display at the world economic forum41:52Kuroda said that the bank of Japan will continue to fight inflation while aggressively stimulating the economy41:58this makes zero sense but the chap is old and about to retire so I reckon we42:03can cut in some slack note that coroda is set to leave on the 8th of April we42:09could see lots of volatility on that date Bruno was the polar opposite of coroda42:16in his passion he essentially said that Europe shifting its Reliance from Russia’s gas to China’s Renewables is42:22stupid as such Europe should start to produce its own wind turbines solar panels and batteries and be very42:29protective of these industries for context U.S President Joe Biden recently passed the deceptively named42:36inflation reduction act which creates huge incentives for green energy companies to relocate from Europe to the42:43United States this has angered the EU which responded by passing the digital42:48markets act that hurts big Tech profits Bruno’s passionate speech took the42:54moderator by surprise and he told Bruno to his face that he had made the audience uncomfortable with his Europe43:00first rhetoric it really was a sight to behold it also revealed which interests43:06are in the control of the weft and just how divided different regions are so43:11much for cooperation in a fragmented world eh crystallina went on to tell the43:16Europeans on the panel to provide more funding to Africa money which Europe doesn’t exactly have at the moment this43:24caused coroda to ask crystallina to send more IMF money to Asia which is a subtle43:29sign that the region is desperately short on US dollars because of rising rates Larry warned about unseen debt in43:36the financial system Christine said she’s worried about being pushed to raise rates too much Bruno called for a43:43ceasefire in Ukraine officially making him the most unpopular person in the eyes of the panel after all the only43:50answer to war is more war so long as the people in power continue to find ways to43:55profit now the last panel discussion from Davos I want to summarize was actually a speech by Antonio guterres44:02Secretary General of the UN this is because the weft is effectively the44:07private sector arm of the UN and has been pushing the un’s sdgs through ESG44:13Antonio’s speech was therefore the most important of all so this speech began44:18with a brief introduction by Klaus who welcomed his Excellency and said the U.N44:23is needed now more than ever Klaus said that the weft is committed to ensuring that the un’s sdgs are44:30implemented which confirmed my long-held suspicions that the weft is the un’s private sector arm then Antonio took the44:38stage he started by saying that the UN needs cooperation not fragmentation to44:43achieve the sdgs he said that the pandemic response was a failure of compliance no doubt he admitted that44:51it’s hard to find Solutions at the best of times and we are not in the best of times Antonio then said something that44:57made me seriously optimistic about the future quote this is undermining45:02everything in other words the UN and the West’s plans are falling apart before45:08their eyes and they’re desperate not to have a repeat of the un’s Millennium development goals or mdgs which failed45:15because of 2008. Antonio proclaimed that the East and West are in the process of45:20separating creating two separate systems two separate currencies and even two separate internet45:26he warned that the weft stakeholders must avoid the quote thucydides trap for45:31those unfamiliar the thucydides Trap is a political Theory which states that a massive war is inevitable when an45:37existing power is being challenged by a rising power in this case the United States being challenged by China45:44now back to Antonio who went on to call for additional funding for sdg compliance and even called for a new45:51debt architecture to ensure the financial system doesn’t collapse as a result of all this funding in his45:58follow-up interview with another weft puppet Antonio admitted that the private sector is slipping away he even46:05instructed the politicians present to ignore what their populations think about them he said that his time in46:11politics had taught him to ignore the opinion of the people and do what is right he said social media must be46:18leveraged as a tool to achieve the un’s vision in case that wasn’t already clear enough the cherry on top was Antonio saying46:25that this is the worst it’s ever been in his lifetime by that he means that this46:31is the least that the average person has listened to the people in power it’s the least that the private sector and public46:37sector have complied the great reset is falling apart in real time so in46:44conclusion then what does all of this mean for you well in short never stop46:49seeking the truth and never stop sharing it they’ll try and take control by putting us in de facto digital prisons46:56with cbdc’s and digital IDs but Alternatives will exist and they will prevail if they’re promoted adopted and47:03crowdfunded I’m confident that cryptocurrency will play a role in this decoupling between the average person47:10and the corrupt institutions that rule them success is by no means guaranteed but the pendulum finally seems to be47:16swinging in the direction of Freedom the wefts self-confidence is waning as its47:22stakeholders realize how out of touch they are with Ordinary People Like Us so let’s keep that momentum going47:34[Music]English (auto-generated)

[ad_2]

Source link